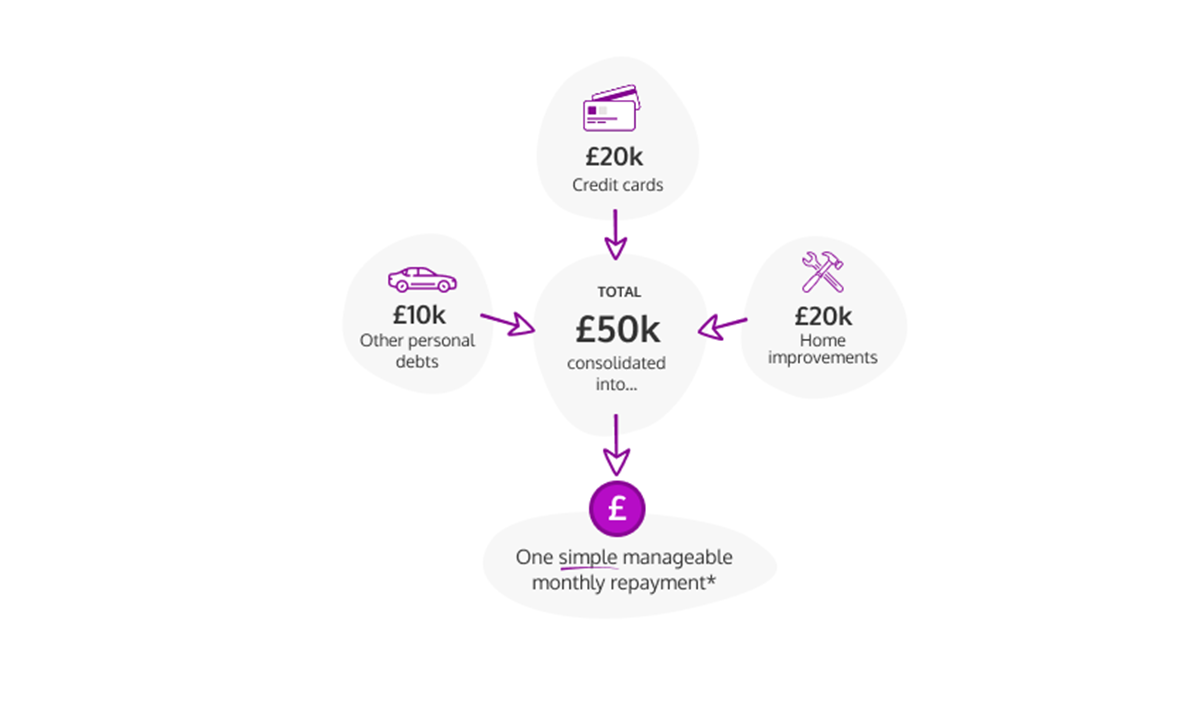

Personal ‘unsecured’ loans and secured loans are completely different forms of borrowing. With a secured loan the debt is linked to your asset (usually the home). A personal loan, also known as an unsecured loan, is not protected by collateral, therefore if you are late with payments or default, your lender cannot automatically take your property, but can go through other methods to reclaim the debt, such as going through the courts. You don’t need to be a homeowner to be eligible for a personal unsecured loan, but you do need to have a fair credit score. You borrow from a lender or bank and agree to make regular payments until the debt is paid off. As the loan is unsecured, the interest rates tend to be higher than with a secured loan, and you may incur extra charges or fees if you miss payments. This can negatively affect your credit rating, making it more difficult to successfully apply for an unsecured loan in the future. The two main types of unsecured loans are opening a line of credit, such as credit cards or store cards, and fixed-interest installment loans such as personal loans, student loans, etc.